Samples of wishes granted include things like remaining a firefighter for every day, seeing the snow for The 1st time and meeting a unicorn.

Autos that do not qualify to generally be provided to the household are bought and assistance fund repairs to application cars and trucks. This way, although your vehicle doesn't run, you happen to be assisting a family get a trustworthy, Doing work vehicle.

The tax Added benefits you will receive are considerable. The IRS now permits you to take a deduction for your fair industry value of your automobile, which could appreciably decreased your tax bill.

Your automobile donation aids advantage disabled veterans through The usa. The proceeds from your donation help to fund plans that present providers offered to veterans needing support and aid. Considering the fact that 2010, Vehicle Donation Foundation's car or truck donation courses have built contributions of much more than $171 million to worthy charities that now include things like charities serving our disabled veterans.

When you donate an auto to Charity Automobiles, managing or not, a hundred% of your donation goes to our charity and helps us provide the present of transportation to your household in want.

These entities depend heavily in your generosity. Each individual auto donated turns into a lifeline, a beacon of hope for people they serve, like the kids battling essential sicknesses supported by Make-A-Want.

Philip S. “This automobile was there for every little thing … the Avalon’s most important journey was the one it took with my daughter … My daughter was only a newborn when she was diagnosed with most cancers, And through These very long months of anxiousness and prayers, the Avalon grew to become a sanctuary. Supporting the ACS grew to become deeply particular to me.

Your charitable act may become a strategic shift, cutting down your taxable cash flow Car Donation Sun City Center FL along with your tax liability.

The non-income charitable organization makes sure usage of the car in charitable deeds. Here is the group that Wheels For Wishes falls beneath.

A: Most states require that you have a transparent title for the vehicle; some states also need a notarized signature to more info complete a donation.

In case your car is sold from the organization for a significant discount to the needy unique, the gross proceeds rule would not implement. As a substitute, you happen to be allowed to assert a deduction based read more upon the car's honest marketplace benefit.

Autos can be an IRS-regarded nonprofit and Furthermore, it Gains through the donation. When the Crimson Cross gets a percentage of the proceeds, Cars and trucks takes advantage of a lot of the donation’s price for its own mission to provide transportation to individuals with mobility restrictions, which include more mature adults and people with disabilities.

When you donate your vehicle read more to a car donation plan that's not registered as being a charity Using the IRS your car donation will not be tax deductible.

Tax prices happen to be lowered through the board, so every single greenback you deduct read more will save you more than it did in advance of.

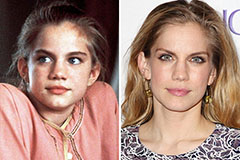

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!